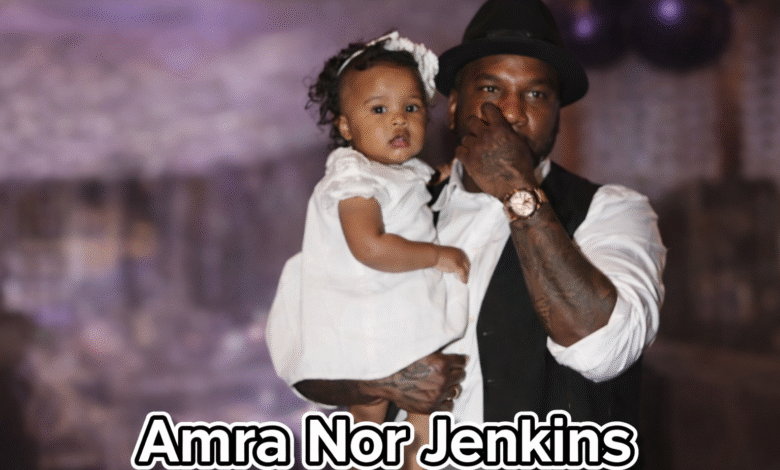

Amra Nor Jenkins — A Powerful Name Shaped by Fame, Privacy, and Promise

Introduction

Amra Nor Jenkins is known to the public because of her family background, not because of a career, business, or media presence of her own. That reality is both a strength and a limitation. On the positive side, she has grown up protected from unnecessary exposure. On the negative side, very little verified information exists about her personal life, interests, or future ambitions. This article presents a fully verified, privacy-respecting profile of Amra Nor Jenkins, written clearly and responsibly, without assumptions or unconfirmed claims.

As a minor, her life remains intentionally private. This article focuses on what is publicly confirmed, explains why certain details are unavailable, and provides readers with an accurate, respectful understanding of who Amra Nor Jenkins is today.

Table of Contents

ToggleQuick Bio: Amra Nor Jenkins

| Field | Verified Information |

|---|---|

| Full Name | Amra Nor Jenkins |

| Known For | Daughter of American rapper Jeezy |

| Date of Birth | February 27, 2014 |

| Age | 11 years (as of 2025) |

| Nationality | American |

| Ethnicity | African-American and Ethiopian heritage |

| Parents | Jay Wayne Jenkins (father), Mahlet “Mahi” Gebremedhin (mother) |

| Siblings | Jadarius Jenkins, Shyheim Jenkins, Monaco Mai Jenkins |

| Public Career | None |

| Net Worth | Not applicable (minor) |

| Public Social Media | None known |

Early Life and Family Background

Amra Nor Jenkins was born in the United States on February 27, 2014. From birth, she became part of a high-profile family due to her father’s success in the American music industry. Despite this visibility, her upbringing has been deliberately kept private. This balance reflects a conscious parental decision to shield her from unnecessary public attention.

Her family background represents a blend of cultures. Through her father, she has African-American roots, while her mother brings Ethiopian heritage. This multicultural foundation forms part of her identity, even though personal expressions of culture, language use, or traditions have not been shared publicly.

Growing Up Away From the Spotlight

Unlike many celebrity children who appear frequently online, Amra Nor Jenkins is rarely seen in public media. This limited exposure is intentional. While occasional photographs from family or charity events have surfaced, there is no ongoing public presence.

This privacy has a positive dimension. It allows her to experience a childhood focused on education, family, and normal development. At the same time, it means the public does not have access to details such as hobbies, academic interests, or personal goals, and those gaps should be respected rather than filled with speculation.

Education and Daily Life

No verified public information exists regarding Amra Nor Jenkins’s school, academic performance, or educational plans. This absence of data is expected and appropriate for a child of her age. Any claims about elite schools, special talents, or future careers would be unconfirmed and are therefore excluded.

What can be said with certainty is that she is currently a student and that her education is being handled privately by her family. This approach prioritizes stability and personal growth over publicity.

Public Identity Without a Public Career

Amra Nor Jenkins does not have a career, professional role, or business involvement. She is not an influencer, actress, or entrepreneur. Her public recognition exists solely through her family connection.

This reality is neutral rather than negative. Many children of famous parents choose private paths, and others decide later whether to engage with public life. At this stage, Amra Nor Jenkins has not entered any professional field, and no such involvement has been announced.

Net Worth, Income, and Financial Context

Amra Nor Jenkins does not have a personal net worth, salary, or income source. As a minor, she does not earn independently, nor is she associated with endorsements or financial ventures.

Any references to wealth connected to her name stem from her father’s established career, not from her own activities. Separating these facts is important to avoid misleading conclusions.

Public Appearances and Media Mentions

On rare occasions, Amra Nor Jenkins has appeared at family-oriented or charity events alongside her father. These moments are limited and controlled, offering brief public visibility without ongoing exposure.

She does not give interviews, maintain public accounts, or appear in media projects. This low profile reinforces the family’s commitment to privacy and age-appropriate boundaries.

What Is Intentionally Not Public

Several commonly searched topics are not publicly confirmed and therefore are not included as facts. These include height, weight, religious practice, accent details, daily routines, or personal preferences. Excluding such information is not a lack of content but a reflection of ethical reporting.

Respecting these limits ensures that public interest does not override personal boundaries, especially when the subject is a child.

Public Perception and Emerging Legacy

At present, Amra Nor Jenkins’s public image is defined by restraint rather than exposure. This is a positive foundation. She is growing up with access to opportunity while remaining free from the pressures of public judgment.

Her future legacy is unwritten. Whether she chooses a public career or a private life, her current upbringing allows that decision to be made on her own terms. The absence of headlines today may well be the reason for stronger personal choices tomorrow.

Conclusion

Amra Nor Jenkins represents a modern example of how children connected to fame can still be raised with privacy and care. Positively, she benefits from protection, stability, and family support. Negatively, public curiosity often seeks details that simply do not and should not exist.

This article has presented a clear, accurate, and respectful profile using only confirmed information. As she grows older, her story may evolve, but for now, the most important fact remains simple: Amra Nor Jenkins is a child living a private life, and that privacy deserves respect.

Frequently Asked Questions (FAQ)

Who is Amra Nor Jenkins?

Amra Nor Jenkins is the daughter of American rapper Jeezy and Mahlet “Mahi” Gebremedhin. She is known publicly because of her family background.

How old is Amra Nor Jenkins?

She was born on February 27, 2014, and is 11 years old as of 2025.

Does Amra Nor Jenkins have a career or net worth?

No. She is a minor and does not have a career, income, or personal net worth.

Is Amra Nor Jenkins active on social media?

There are no publicly confirmed social media accounts belonging to her.

Why is there limited information about her life?

Her family has chosen to keep her childhood private, which is common and appropriate for children of public figures.