CycleMoneyCo Cash Around: A Smart Framework for Mastering Cash Flow

In the modern digital economy, effective cash flow management is no longer optional—it is essential for survival and growth. Businesses and individuals alike face increasing pressure to manage money efficiently, respond quickly to financial demands, and reduce reliance on external borrowing. CycleMoneyCo Cash Around introduces a smarter, technology-driven approach to keeping money active, fluid, and productive.

Unlike traditional financial systems that allow funds to sit idle, cyclemoneyco promotes continuous movement of cash through intelligent automation and real-time financial insights. This approach helps transform cash from a passive resource into a strategic tool that supports stability, scalability, and long-term success.

What Is CycleMoneyCo Cash Around?

CycleMoneyCo Cash Around is an advanced cash flow management concept designed to keep money circulating efficiently across all financial touchpoints. Traditional cash handling often results in delays caused by late receivables, inefficient payment cycles, or excess inventory. These delays restrict liquidity and limit growth potential.

The cyclemoneyco model focuses on maintaining a steady flow of funds by aligning income, expenses, and reinvestment strategies. Through automation, analytics, and predictive tools, it ensures that money is always positioned where it can deliver the most value. This creates a financial environment where cash works continuously rather than waiting for manual decisions.

Why CycleMoneyCo Is Changing Modern Finance

The financial world has shifted rapidly due to fintech innovation, artificial intelligence, and digital banking. In this environment, speed and adaptability determine success. CycleMoneyCo Cash Around addresses one of the biggest weaknesses in traditional finance: slow-moving money.

Instead of holding cash in dormant accounts, cyclemoneyco enables real-time fund allocation and intelligent decision-making. This approach supports better planning, improved liquidity, and reduced exposure to financial shocks. By treating cash as an active asset, businesses and individuals gain more control over their financial outcomes.

How CycleMoneyCo Cash Around Works

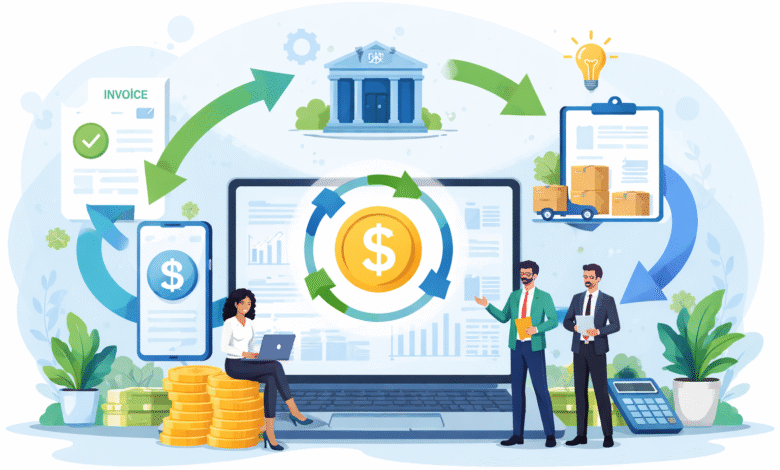

At the heart of cyclemoneyco lies a continuous cash cycle that connects receivables, inventory, and payables. Each component is optimized to minimize delays and maximize efficiency.

Receivables are accelerated using smart invoicing and automated reminders, ensuring faster customer payments. Inventory levels are guided by real-time data, preventing excess stock that ties up capital. Payables are managed strategically, allowing businesses to maintain supplier relationships while preserving liquidity.

Artificial intelligence analyzes transaction patterns, identifies bottlenecks, and automatically adjusts workflows. This ongoing feedback loop ensures that cash remains in motion, improving turnover and financial flexibility.

Key Features of CycleMoneyCo Cash Around

One of the most powerful aspects of cyclemoneyco is its feature set, which goes beyond traditional financial tools. Real-time cash tracking ensures complete visibility into fund movement. Automated transfers move money between accounts based on predefined rules and priorities.

Predictive analytics help anticipate shortages or surpluses before they occur, allowing proactive action. Built-in security and compliance monitoring reduce risk while ensuring regulatory alignment. Visual dashboards translate complex financial data into easy-to-understand insights, making decision-making faster and more accurate.

Benefits of CycleMoneyCo for Businesses and Individuals

The advantages of CycleMoneyCo Cash Around are significant for both businesses and individuals. Businesses benefit from faster cash cycles, improved working capital, and reduced dependence on loans or credit facilities. With better liquidity, companies can reinvest sooner, expand operations, and respond quickly to market opportunities.

For individuals and freelancers, cyclemoneyco supports smarter budgeting, automated savings, and structured debt management. Instead of letting income sit idle, funds are actively directed toward financial goals, creating a more disciplined and sustainable personal finance system.

Real-World Applications of CycleMoneyCo Cash Around

The practical impact of cyclemoneyco can be seen across multiple industries. Small retailers improve liquidity by shortening payment cycles. Freelancers automate income distribution for taxes, savings, and expenses. E-commerce businesses avoid overstocking by aligning inventory purchases with real-time sales data.

Service-based companies synchronize client payments with operational costs, reducing cash gaps. Startups benefit from stronger cash flow forecasts, improving credibility with investors. These real-world examples demonstrate how CycleMoneyCo Cash Around delivers measurable improvements across diverse financial environments.

CycleMoneyCo vs Traditional Cash Flow Models

Traditional cash flow management relies heavily on spreadsheets, manual monitoring, and delayed reactions. These methods are time-consuming, error-prone, and difficult to scale. CycleMoneyCo Cash Around, in contrast, provides automated, data-driven financial control.

With cyclemoneyco, users gain instant visibility, predictive insights, and scalable automation. Manual tasks are reduced, operational efficiency improves, and financial decisions become more strategic. This shift represents a fundamental evolution in how cash flow is managed.

How to Implement CycleMoneyCo Cash Around

Successful implementation of cyclemoneyco begins with a clear assessment of existing financial processes. Identifying where cash becomes stagnant is essential. Once weak points are identified, businesses can integrate suitable digital tools that support automation and data analysis.

Training staff and defining key performance indicators such as cash turnover and payment cycles ensures alignment. Continuous monitoring allows the system to adapt as financial conditions change. Over time, CycleMoneyCo Cash Around becomes an intelligent engine that evolves with the organization.

Challenges and Risk Management

While cyclemoneyco offers powerful advantages, it also requires careful implementation. Inaccurate data can affect automation accuracy, and legacy systems may pose integration challenges. Resistance to change is another common obstacle.

These risks can be minimized through gradual adoption, proper training, and human oversight. Combining automation with expert review ensures that financial intelligence remains balanced and reliable.

Future Outlook of CycleMoneyCo Cash Around

The future of CycleMoneyCo Cash Around is closely tied to advancements in financial technology. Upcoming developments may include blockchain-based transparency, multi-currency automation, and advanced scenario modeling. These innovations will further strengthen the ability of cyclemoneyco to support global, real-time financial ecosystems.

As finance becomes more digital and intelligent, systems that keep cash active and adaptable will define the next generation of financial management.

Conclusion

CycleMoneyCo Cash Around represents a smarter way to manage money in a fast-changing world. By keeping cash in constant motion, it enhances liquidity, improves decision-making, and supports sustainable growth. Whether for businesses, freelancers, or individuals, cyclemoneyco transforms cash flow from a challenge into a strategic advantage.

In an economy where speed and intelligence matter, letting money sit idle is no longer an option. With CycleMoneyCo Cash Around, cash stays active, purposeful, and aligned with long-term financial success.

FAQs

1. What is CycleMoneyCo Cash Around?

CycleMoneyCo Cash Around is a modern cash flow management system that uses automation and data insights to keep money circulating efficiently.

2. Who can benefit from cyclemoneyco?

Small businesses, startups, freelancers, and individuals can all benefit from improved liquidity and smarter cash handling.

3. How quickly does cyclemoneyco show results?

Many users see improved cash visibility and faster cycles within 30–60 days of implementation.

4. Does CycleMoneyCo replace accounting software?

No, cyclemoneyco integrates with existing systems and adds an intelligent optimization layer.

5. Is CycleMoneyCo suitable for uncertain economic conditions?

Yes, by improving liquidity and forecasting, cyclemoneyco helps build financial resilience.

blogbuz